The 11 Best Payroll Software in Canada

By Arthur Dubois | Published on 21 Sep 2023

Whether you juggle roles at a startup or head up a growing company, you want to get payroll right. Not just the first time, but every time. This guide takes you on a shortcut to that goal thanks to the best payroll software in Canada.

First, we break down the essential features your ideal Canadian payroll software should have. Then, we roll out the red carpet for the 11 standout payroll software options in Canada. In each case, we vet them for ease of use, features and scalability.

How to Choose a Payroll Software for Your Business in Canada

Selecting the best payroll software in Canada does not just tick a box. Ideally, it delivers a comprehensive solution that addresses both your immediate and future needs. Given the gamut of options in the market, this list of factors guides you toward a well-informed decision:

Comprehensive Payroll Processing and Tax Calculations

Your payroll system should ably handle a variety of calculations, such as Canada Pension Plan (CPP) and Employment Insurance deductions. Additionally, you rely on this software to record bonuses, holiday pay and overtime. Scrutinize potential vendors about these capabilities to assess how they can help you fulfill your governmental remittance and filing obligations.

Moreover, ask if the system automatically updates tax rates and forms, files Records of Employment (ROE) with Service Canada. Finally, seek one that automates provincial tax remittances. A good software should also facilitate remittances to third-party vendors, like benefits providers and Registered Retirement Savings Plan (RRSP) contributions.

Monitoring Compliance Changes

Compliance in Canada continually evolves. Therefore, opt for a payroll software that not only ensures current compliance but also continuously updates you on legislative changes. Look for providers who offer an information centre or regular updates to stay abreast of any legal and regulatory modifications.

Provincial Compliance

Within payroll processing in Canada, each province has its own set of rules and regulations, making provincial compliance critical. While many payroll software solutions offer comprehensive Canadian coverage, verify if they fully support specific payroll requirements in your province. After all, regions like Quebec have unique tax rates and employment standards. Choose a payroll software that ensures accurate payroll processing, tax deductions and reporting tailored to your province’s distinct mandates. Taking these steps safeguards your business against potential compliance issues.

Employee Self-Service and Mobile Accessibility

Employees today expect real-time access to their payroll data. Opt for a software with an employee self-service portal that’s also mobile-responsive. This not only empowers employees but can significantly reduce administrative burdens on your HR team.

Advanced Payroll Reporting

Further, select a software with advanced reporting capabilities for making informed business decisions. Your chosen software should offer pre-built payroll and year-end reports with the ability to customize reports for deeper insights.

Accounting Software Compatibility

Your payroll software should seamlessly integrate with your existing accounting software. This ensures that all your financial data synchronizes, providing a cohesive overview of your business finances. That way, you reduce the need for manual data entry or cumbersome reconciliations.

Proven Expertise

When talking to potential vendors, inquire about their experience in handling businesses similar to yours. Above all, make this a priority if you anticipate growth or expansion into different provinces or territories. Ask for case studies or testimonials for a clearer understanding of how well the software adapts to evolving business needs.

Flexibility for Future Growth

A payroll system should go beyond just a software; it should serve as a partner that grows with you. Investigate how easily you could add new modules or adapt to changing employee assignments, locations and pay rates. The last thing you want is a system that becomes obsolete just as your business scales up.

Armed with this knowledge, get ready to explore the best options available in the Canadian market. Stay tuned as we delve into the best payroll softwares in Canada. Each with its own unique features and advantages tailored to diverse business requirements.

Wave Payroll – Best for Simple Payroll Needs

Wave Payroll stands as a product of Wave Financial Inc., a Canadian fintech company that H&R Block acquired in 2019. The software aims to simplify the payroll process, targeting small and medium-sized businesses across Canada, except Quebec. (Employers in Quebec remit to Revenu Québec instead of the Canada Revenue Agency.) It serves as an affordable, straightforward payroll option that aligns well with its free bookkeeping software.

Wave Payroll’s uncomplicated pricing offers a base fee of $25 CAD plus $6 per employee or contractor per month. The payroll module includes unlimited direct deposits, an employee portal and automatic tax remittance to the Canada Revenue Agency (CRA). It even offers the generation of Records of Employment (ROEs) and T4 or T4A slips. To give users a feel for the software, Wave offers a 30-day free trial that doesn’t require any credit card information or commitment.

However, while Wave Payroll excels in user-friendliness and offers a handy self-serve employee portal, it lacks in certain areas. The software’s simplicity translates to limitations on its features. For instance, it does not support employee department classifications and offers limited reporting capabilities. Notably, without integrations with third-party bookkeeping, users must manually record payroll data if not on Wave’s own bookkeeping platform. Moreover, customer support primarily consists of an email ticketing system and chatbot during office hours only. This could create problems when you need timely support.

Headquartered: Toronto, Ontario

Founded: 2009 (by Wave Financial Inc., acquired by H&R Block in 2019)

Pricing: $25 CAD base fee plus $6 per active employee or contractor

Provincial Availability: Offered in every province and territory, except Quebec.

Accounting Software Compatibility: Its payroll platform works seamlessly with its programs, like Wave Invoicing and Wave Accounting. However, it doesn’t jibe well with other third-party software.

Unique advantage: As a modern, mobile-friendly payroll interface, Wave has a quick learning curve. Due to its simplicity, it works best for single freelancers or small businesses with fewer staff members.

QuickBooks Payroll – Best for QuickBooks Online Users

QuickBooks Payroll serves as a convenient add-on for users of the widely adopted QuickBooks Online bookkeeping platform. Its strongest selling point focuses on this seamless integration, making it ideal for businesses already operating within this ecosystem. This integration allows for a streamlined approach to financial management, as payroll data easily imports directly into the business’s books.

The software is designed for accountants, offering a straightforward experience that caters well to basic payroll needs. Its intuitive interface allows users, even those without specialized payroll knowledge, to navigate its features with ease. However, due to its number of tools, it can take time to learn all its features to your full advantage.

In addition to simplifying the payroll process, QuickBooks Payroll also offers a degree of automation. Users can pay employees via direct deposit, automate payroll remittances and even prepare year-end filings. As a result, staff reduce the manual work involved in these tasks.

However, QuickBooks Payroll charges higher rates in addition to your existing fees. These extra costs range from $25 to $80 a month, depending on your needs, although at half price for the first three months. Therefore, this software may not offer the best value for businesses that don’t already use QuickBooks for their bookkeeping needs.

As a bonus, QuickBooks tracks employee and contractor payroll, HR and benefits, employee time and tax filings and payments. If you bill your clients by the hour, its item-based pricing makes life easier. Further, it can scale to grow with your business as it becomes more complex.

Headquartered: Mountain View, California

Founded: 1983 (by Intuit Inc.)

Pricing: $25 to $80/month, in addition to QuickBooks Online base subscription ranging from $24 to $140 per month. Add $4 per employee per month for the Core program, $8 for Premium and $15 for Elite.

Provincial Availability: Available in all Canadian provinces and self-serve in 14 U.S. states

Accounting Software Compatibility: QuickBooks

Unique advantage: For those starting small but planning to grow, investing in QuickBooks keeps you on one system. It may take a little longer to learn, but gives you more robust options once you have more staff and projects.

Wagepoint – Best for Competitive Pricing with Great Service

Wagepoint was specifically crafted for small businesses, founded in 2012 with a focus on creating a stand-alone, user-friendly payroll solution. Its web-based interface enables you to manage everything from employee payments to tax remittances, and even year-end reports with ease. Its seamless integration capabilities with popular accounting software, like QuickBooks and Xero, facilitate a streamlined accounting process for businesses.

With Wagepoint, each pay run gets based on timing and employee numbers. For example, its online calculator shows that a company with four employees pays $28 for each biweekly pay period. However, if you have 50 staff members, the fee goes up to $120 per cycle. The software also offers optional add-ons: Track for time-tracking or Luna for paid time-off (PTO) management, for extra fees. For those who are budget-conscious, the overall cost of Wagepoint’s services proves to be among the most affordable in the online payroll software market.

Wagepoint outshines its competitors for its excellent customer service. Over the years, users have built strong relationships with customer service representatives, attesting to the high level of support provided. The platform makes it easier to onboard new staff with a graphic-rich walk-through of its steps. Wagepoint further enhances the employee experience by offering a dedicated portal. Once logged in, they can manage their personal information and access key documents like pay stubs and T4s.

However, Wagepoint has its limitations. Currently, it lacks a dedicated mobile app, making on-the-go access less convenient. Additionally, it doesn’t offer any built-in HR functionalities, which could help businesses seeking a more comprehensive software solution. While it does offer an extra time-tracking feature, it comes at an additional cost.

Headquartered: Calgary, Alberta

Founded: 2012

Pricing: $20 base fee per pay run plus $2 per employee. Optional add-ons for time-tracking and time-off management are also available at extra costs.

Provincial Availability: Available across Canada

Accounting Software Compatibility: Works with QuickBooks, Xero.

Unique advantage: If you want responsive customer service and easy onboarding, Wagepoint delivers. All this comes at a price that makes up for its shortcomings on the mobile front.

Payworks – Best for On-Demand Professional Support

Founded in 2001, Payworks has evolved from a payroll-only provider to a comprehensive HR management solution with a national presence. Headquartered in Winnipeg, Manitoba, the company offers a robust payroll module that automates key processes. These include tax remittances, work-safe premiums, T4 preparations and ROE submissions to Service Canada. Payworks stands out for dedicating service representatives for each customer, ensuring personalized support throughout the onboarding process and beyond.

Uniquely, Payworks charges per pay run rather than a monthly subscription. With a base fee of $20.90 and an additional $2.10 per employee, the pricing can be cost-effective for businesses, particularly those with fewer pay cycles. For instance, to pay four employees in Ontario costs $30.70; for 20 workers, the total comes to $65.90. Test out your numbers with its handy cost calculator.

Payworks excels in the realm of customer support. Unlike platforms that operate through a call centre or ticketing system, Payworks assigns a professionally trained representative to each client. This ensures that any queries about the software, payroll procedures, or tax updates get addressed promptly and effectively. The company promises to have your call answered by a human within 60 seconds. This sets a high standard for customer service in the industry.

Added advantages include a dedicated onboarding specialist to aid in the complex task of payroll setup to avoid costly mistakes. The payroll module ranks just behind Wagepoint in terms of cost-effectiveness for the level of service. As of March 2023, Payworks also offered direct integrations with popular bookkeeping software Xero and QuickBooks.

However, the platform has its drawbacks. While Payworks offers a robust reporting system, its complexity and customization options can make it less user-friendly than other alternatives.

Headquartered: Winnipeg, Manitoba

Founded: 2001

Pricing: $20.90 base fee per pay run plus $2.10 per employee. Additional modules and costs vary.

Provincial Availability: Offered across Canada with 12 offices in seven provinces

Accounting Software Compatibility: Works with Xero and QuickBooks

Unique advantage: If you struggle with processes like payroll, Payworks gives you the support you need to set up and go. Its affordable rates reward you with better customer service, with staff dedicated to give you a good experience.

Knit People – Best for Growing Companies’ Evolutions

Knit People, based in Toronto, Ontario, has served Canadian businesses since 2015 with an all-in-one HR and payroll platform. Specializing in small and medium-sized businesses, Knit offers a full suite of features. They range from multiple pay rates to automated calculations (for workers’ compensation and Employer Health Tax), T4s and ROE preparation.

Distinctly, Knit serves as a single platform for both HR and payroll. This duality makes it an attractive choice for businesses looking to streamline these functions.

Knit employs a three-tiered pricing model with options to cater to different business needs. The “Lite” plan starts at $40 per month as a base fee, with an additional $6 per month per employee. The Complete and Concierge plans offer more extensive HR functionalities, priced at $50 and $300 per month as base fees, respectively. Then, tack on with additional per-employee charges of $8 and $25. The pricing structure is transparent and easily understood.

In terms of customer support, Knit provides an excellent customer service experience. It operates an after-hours hotline and email-response team to provide immediate, professional assistance. This adds an extra layer of comfort and confidence for businesses navigating complex payroll and HR tasks.

One of the notable advantages of using Knit is the option to conduct advanced custom pay runs. If your business deducts donations, union dues or third-party RRSP payments, Knit offers the flexibility to accommodate these complexities. Added to this, the 30-day free trial gives potential customers risk-free opportunities to assess the platform’s fit for their operations.

The platform does have some room to grow, however. Knit does not currently offer a mobile app, limiting access for smartphone fanatics. It also lacks the ability to file T4As for contractors and does not provide support for businesses located in Quebec. Additionally, you cannot set up multiple rates for employees or deduct alimony payments.

Headquartered: Toronto, Ontario

Founded: 2015

Pricing: Starting at $40 per month and $6 per employee per month for the Lite package; $50 plus $8 per employee per month for Complete. You pay $300 a month and $25 per staffer for the Concierge service where they manage your payroll and HR for you.

Provincial Availability: All of Canada, except Quebec

Accounting Software Compatibility: Integrates with Xero and QuickBooks

Unique advantage: The pricing works well for every level: affordable for startups and equipped for large companies looking to outsource. You can stick with one platform as you scale up without the hassle of switching.

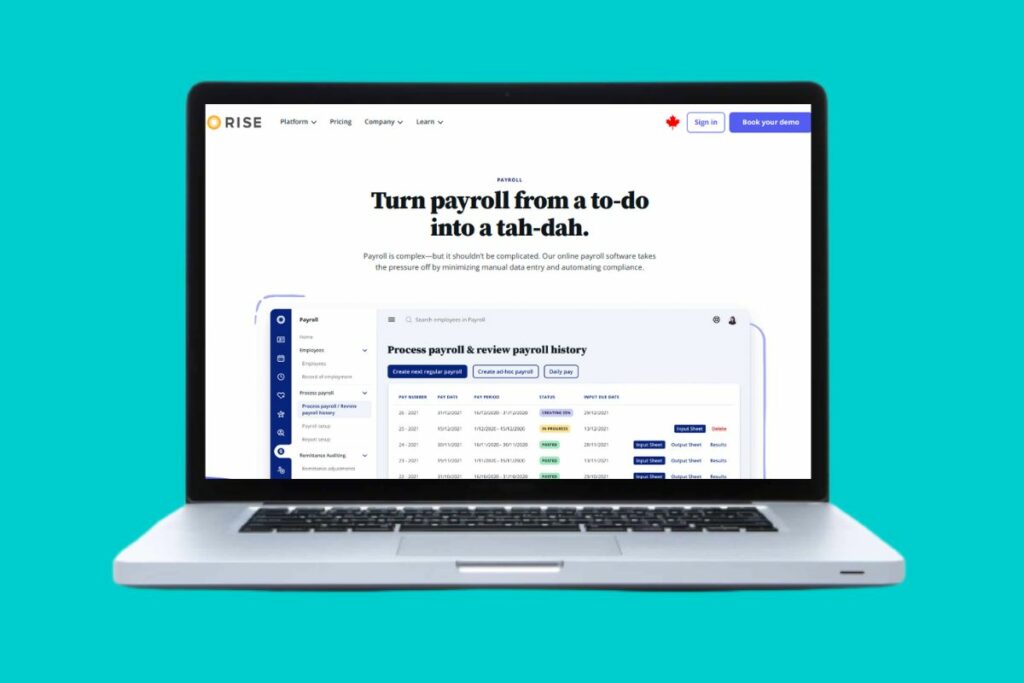

Rise People – Best Mobile All-in-One HR/Payroll Solution with Benefits

Founded in 2011, Rise People offers a comprehensive suite of employee-management solutions tailored to small to medium-sized businesses. Its modules cover payroll, people management and even wealth management, all integrated into a single platform. Notably, Rise also provides the option to incorporate employee benefits, which can further reduce the software costs.

Rise employs a tier-based pricing model with three different plans: Start, Grow, and Optimize. The Start Plan begins at $6 per user per month, dropping to free if you integrate benefits through Rise. This plan covers basic HR and payroll functionalities and includes access to Rise Wealth for employee financial wellness. All pricing tiers have an additional $30 fee for businesses with fewer than 20 employees, making it slightly more expensive for smaller setups.

Customer support at Rise works efficiently and its platform is user-friendly. However, where Rise truly stands out is in its flexibility. You can start with essential payroll services then scale up to more advanced HR modules as your business grows. This makes it a one-stop shop for companies looking to handle HR, payroll and benefits under a single umbrella.

Unlike some competitors that lack robust mobile support, Rise provides comprehensive access through its app. Employees can check pay stubs, request time off and even engage with their benefits and investment portfolios.

However, Rise’s setup for the payroll module can challenge new users. Additionally, the two different prices per tier and an extra fee for smaller businesses can confuse comparison shoppers. While the overall cost may go higher, the integrated approach and full-feature set may justify the price for many businesses.

Headquartered: Burnaby, British Columbia

Founded: 2011

Pricing: Starting at $6 per user per month, with various tier options and additional $30 fees for smaller businesses with fewer than 20 employees.

Provincial Availability: Offered in every province and territory

Accounting Software Compatibility: Works with Xero

Unique advantages: Excelling at mobile, Rise People offers the chance to manage payroll, people management, wealth management and benefits in one place. It even becomes more affordable when you add that final piece.

ADP Workforce Now – Best for Large Enterprises

Founded more than 70 years ago, ADP provides payroll and HR software solutions for businesses of all sizes. Its flagship product, ADP Workforce Now, serves as an all-in-one platform for payroll, HR, time management, talent and benefits. With a focus on large enterprises, the platform offers an extensive range of customized add-on modules for specific business needs.

Its real-time update capability eliminates the need for repetitive data entry and ensures consistency in record-keeping across all systems. The platform also offers an employee self-service portal whose tools take care of time-tracking, scheduling, PTO requests and benefits management. These features extend to the mobile app. As a result, employees conveniently manage their work-related tasks without requiring intervention from HR or payroll administrators.

ADP Workforce’s weaknesses

However, ADP Workforce Now isn’t perfect. Some users describe its interface as less intuitive and outdated when compared to newer, more agile platforms. This can result in a steep learning curve for users unfamiliar with the system. Also, the platform’s implementation process can require extensive hand-holding.

Given that ADP primarily caters to big businesses, its customer support can feel less personalized. This could concern businesses that require frequent and responsive assistance.

When it comes to pricing, ADP employs a customized model that depends on various factors such as employee count, pay schedule and integration requirements. Overall, expect to pay $15 to $24 per employee per month. This cost makes it less suitable for small businesses on a limited budget. Moreover, the high implementation fees and add-on pricing structure can deter smaller enterprises from adopting the platform.

In summary, ADP Workforce Now better suits enterprises that need an all-inclusive, customizable HR and payroll solution. Its scalability and comprehensive feature set make it ideal for businesses with complex requirements and large employee counts. Smaller businesses, however, may find the system costly and less user-friendly, especially if they require personalized customer support.

Headquartered: Roseland, New Jersey

Founded: 1949

Pricing: Typically $15 to $24 per employee per month. Enhanced, Enhanced+ and HR Pro levels get assessed based on employee count, pay schedule and additional features and integrations.

Provincial Availability: Offered in every province and territory

Accounting Software Compatibility: Integrates with Wave, Xero and QuickBooks

Unique advantage: ADP Workforce Now frees up larger corporations looking to hand off payroll to focus on its core business. It acts and thinks like a big business, adapting just like its clients must.

Simplepay.ca – Best for Cost-Effective Software for SMBs

Based in Mississauga, Simplepay.ca specializes in providing a cloud-based payroll solution tailored for small to mid-sized Canadian businesses. It starts at $25 per payroll run with a pricing model of $1.50 per employee. Further, it offers an array of features, such as direct deposits, tax remittance management, statutory holiday calculators and timesheets.

Its transparent pricing gives you options to add automated remittances for an extra $5 or automated ROE for $3. Moreover, contractor pay costs an additional $1.50. Despite the absence of a free trial, the platform offers both phone and email customer support.

SimplePay.ca thrives due to its ease of use and simple pricing model. Businesses can also easily import and export data via its multiple integrations. It supports e-filing for all Canadian provinces, including Quebec. However, it only operates in English, not French.

However, its critics find its mobile version and user interface less than stellar. Yet, they report the information loads quickly and they learned how to tap into it effortlessly. As a bonus, Quebec users report that it adapts well to their payroll systems compared to other software.

Finally, users rave about the customer service offered by SimplePay.ca. They find it easy to adopt but quickly connected with support by phone when needed. Compared to other companies, its payroll calculator stands out for its level of detail.

Headquartered: Mississauga

Founded: 2005

Pricing: Starting at $25 per payroll run, with additional charges for automated remittances, automated ROE, and contractor pay.

Provincial Availability: Offered in every province and territory

Accounting Software Compatibility: Integrates with Xero

Unique advantage: For a quick, modern, stripped-down payroll solution, SimplePay.ca lives up to its name. It may not be fancy, but it works to offer what you need at a good price.

Ceridian Dayforce – Best Time-Saver for Big Businesses

Ceridian Dayforce provides an all-in-one platform that integrates HR, payroll, benefits, workforce management, and talent management. Its platform offers a high degree of customization to cater to complex business needs of large enterprises.

However, this customization comes at the cost of a less transparent pricing structure; companies interested in Dayforce will need to reach out to Ceridian for a quote tailored to their unique requirements.

When it comes to customer support, Ceridian opts for a more broad-based approach rather than a personalized one. That support is robust, it may not offer the same level of individualized attention as some smaller platforms.

On the feature side, Dayforce‘s unified platform reduces the need for duplicate data entries by centralizing various HR functions. It also shines in its scalability and customization, designed to meet the needs of large, dynamic companies. Furthermore, its strong emphasis on employee self-service serves as a boon for HR departments. It allows employees to manage their paycheck details, tax forms and other information via a personal portal.

However, the platform has its downsides. Some users find the range of features overwhelming, leading to slower onboarding as the system seems less intuitive to navigate.

Dayforce is an excellent fit for large organizations in need of a comprehensive and flexible HR and payroll solution. Smaller companies or those seeking more straightforward services may find it less suitable.

Headquartered: Minneapolis, Minnesota

Founded: 1992

Pricing: Not publicly disclosed but customers cite ranges of $22 to $30 per employee per month after a one-time implementation fee

Provincial Availability: Offered in every province and territory

Accounting Software Compatibility: Integrates with QuickBooks

Unique advantage: Ceridian Dayforce effectively streamlines processes, like data entry, for large companies who could easily get weighed down by time-eating duplication. It also grows with them while empowering employees to bypass HR with self-service.

eNETEmployer by CanPay – Best Deadly Accurate Software

Founded in 1985 in Winnipeg, Manitoba, eNETEmployer offers a wide range of cloud-based payroll and HR solutions. Tailored specifically for Canadian small to medium-sized businesses, its suite includes automated tax calculations, management of deductions and benefits. Even better, it delivers an employee self-service portal. Moreover, the platform boasts robust security features, including 256-bit TLS encryption and Code Signing Digital IDs.

In terms of pricing, eNETEmployer employs a modular approach with three distinct plans: Self-Service, Partial Service and Full Service. The Self-Service Plan starts at $10 per payroll run with an additional $1.30 per employee, offering affordability and scalability. Partial Service costs $15 per run, $1.50 per staff member and 50 cents for direct deposit and other fees. For Full Service, the cost goes up to $20 per run and $1.80 per worker.

You can reach customer support via phone and email, ensuring effective problem-solving and assistance. The platform allows businesses to start with essential payroll features then expand to more advanced HR modules as they grow. This makes it a versatile choice for a range of operational needs.

Take a 30-day free trial to thoroughly evaluate the software before committing. However, eNETEmployer does not manage payroll across multiple locations. Yet, it stands out for its multi-language support. Unlike some competitors, this platform works in both English and French, catering to a wider Canadian audience.

While the software offers a plethora of advantages, it has its drawbacks. Users have reported occasional slow loading times and no mobile application to provide access while in transit. They also find the processes cumbersome and hard to learn. For instance, they have to hide columns to get an overview of the reports.

Headquartered: Winnipeg, Manitoba

Founded: 1985

Pricing: Starting at $10 per payroll run and $1.30 per employee and rising to $20 per run and $1.80 per employee per month.

Provincial Availability: Offered in every province and territory

Accounting Software Compatibility: eNETEmployer interfaces with any third-party accounting products that support a comma-separated value (CSV) file, including QuickBooks.

Unique advantage: While it may be slow, the software has checks and balances to ensure accuracy in deductions, etc. As such, it gives its users strong confidence when facing an audit without double-checking entries.

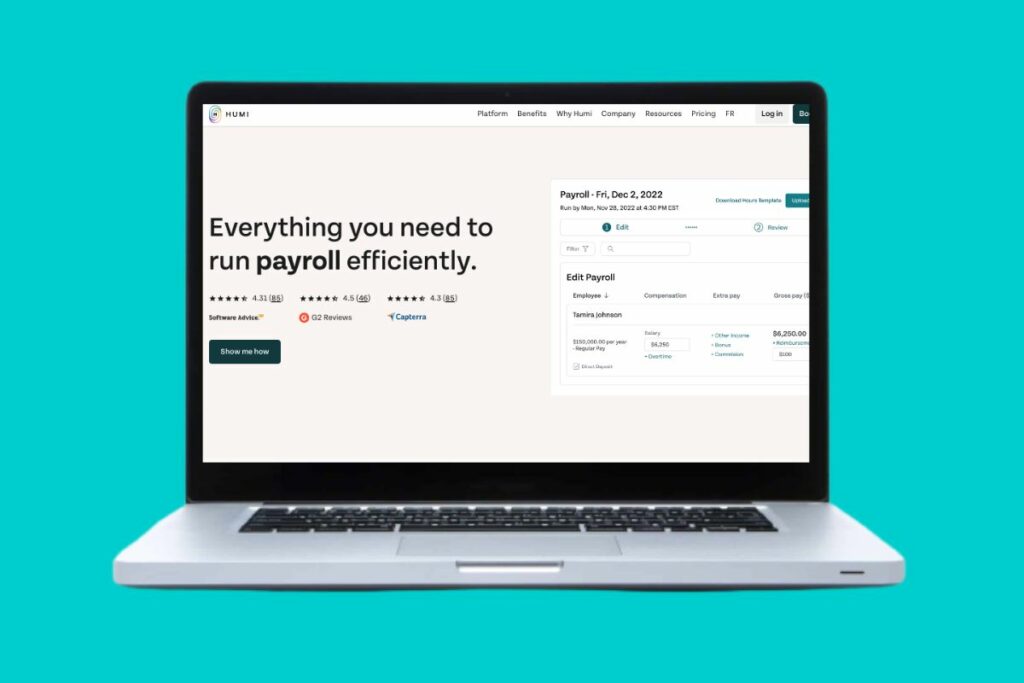

Humi – Best Modular Solution for Businesses of All Sizes

Humi has a comprehensive, customizable platform tailored to the HR and payroll needs of Canadian businesses, both small and large. The platform integrates everything from automatic CRA remittances, T4 and ROE preparations to more advanced functionalities, like multi-province payroll and bonuses. This all-in-one approach extends to various modules, including time-off tracking and performance reviews, unifying HR for businesses and their employees.

In terms of pricing, Humi employs a modular system. Its monthly base fee starts at $49 with an additional $6 per user per month for the mandatory Core module. Other modules like Payroll, Time Off and Performance are priced at $6, $5 and $3 per user per month, respectively.

For instance, a business with 10 employees opting for the Core, Payroll, Time Off and Performance modules would pay $249 per month. Although the Core module makes the entry cost slightly higher, the flexibility of adding only necessary modules can be cost-effective.

Specialty modules

Humi’s Time Off module has streamlined leave management for many companies, even replacing rudimentary methods like Google Sheets. Employees can easily request leaves and supervisors can approve or deny these, all from within the platform. The platform’s scalability also pays off. As a business grows, Humi’s modular design allows for easy expansion of services, effectively growing with the company.

However, while the per-module pricing allows businesses to customize their services, costs can add up quickly, especially for smaller businesses. Despite this, Humi remains an attractive choice for those looking for an integrated HR and payroll solution with the flexibility to scale according to business needs.

Headquartered: Toronto, Ontario

Founded: 2016

Pricing: Monthly base fee of $49, plus additional costs per module per user (e.g., $6/user/month for the Core module, $6/user/month for Payroll, $5/user/month for Time Off, etc.). Total costs vary depending on the number of modules and users.

Provincial Availability: Offered in every province and territory

Accounting Software Compatibility: Integrates with Xero

Unique advantage: With Humi, companies can add modules as they grow. This scalability provides the support they need without costs that hurt their bottom line. They get a solid range of services, customized to their needs.

Best Payroll Softwares in Canada: The Bottom Line

Choosing the right payroll software drives success or stress for businesses of all sizes. Whether you prioritize user-friendliness, comprehensive features, or budget-friendly pricing, a solution in our list suits your needs. As Canadian businesses continue to evolve, the need for dependable, versatile payroll solutions matters more than ever. Investing in the right platform can significantly streamline your HR and payroll processes, saving both time and money.

[Offer productType=”OtherProduct” api_id=”6500bf99d0716c62ae216b59″]FAQs About Payroll Softwares in Canada

Payroll software automates and streamlines the various tasks associated with running a payroll via is a digital solution. These tasks may include tracking working hours, calculating salaries and wages, distributing paychecks, and handling tax deductions and other withholdings. By using payroll automation, businesses ensure accurate and timely payment to their employees while complying with relevant tax laws.

In Canada, payroll software automates tasks associated with employee payment to comply with Canadian tax laws and employment regulations. These tasks include calculating federal and provincial income taxes, Canada Pension Plan (CPP) contributions, and Employment Insurance (EI) premiums. Many accounting softwares for small businesses come with modules for time-tracking and HR management for an all-encompassing employee-management system.

Once the payroll manager enters the employees’ hours, payroll software solutions automatically deduct employee salaries from the business’s bank account. They then send wire transfers or issue paycheques to employees.

For small businesses in Canada looking for free payroll software, Wave offers accounting and payroll services tailored to their needs. Keep in mind that the term “best” remains subjective. It depends on various factors like the size of your business, required features and ease of use. Therefore, evaluate different options to determine which one best suits your specific needs.

The popularity of payroll software can vary depending on the criteria you’re looking at. Consider user reviews, number of customers or breadth of features, for instance. However, softwares like ADP Workforce Now, Ceridian Dayforce and QuickBooks Payroll are among the most used in Canada. However, popularity doesn’t necessarily equate to being the best fit for your business needs.

While you could manually manage payroll for one employee, using payroll software can greatly simplify the process and minimize errors. The software can automate tax calculations, benefit deductions, and more, saving you time and ensuring compliance with Canadian tax laws. Even for one employee, payroll software can serve as a beneficial tool, although not strictly necessary.

To set manual payroll, first, create a new spreadsheet and make a list of all your employees. Alongside their names, note down essential information like their hourly wage or salary, tax withholding rates and Social Insurance Numbers. Next, make another sheet within the same spreadsheet to track work hours for each employee. If your employees get salaries, you can simply note down their payment schedules here. Once you’ve noted the hours or payment periods, create another sheet to calculate how much everyone earns. For hourly employees, multiply their rate by their hours worked. For salaried folks, divide their annual salary by the number of pay periods in a year to figure out each paycheck.

Now comes the tax part. Create a separate sheet where you calculate all the deductions that need to come out of each paycheque. This includes federal and provincial taxes, as well as contributions to the Canada Pension Plan (CPP) and Employment Insurance (EI). Once you’ve calculated all the deductions, subtract them from the gross pay. What’s left is the net pay, which is what you’ll pay out to your employees. Create a sheet to record this net pay and how you’ll pay it, via direct deposit, cheque or another method. Don’t forget that you also have to remit the withheld taxes and contributions to the Canadian Revenue Agency (CRA). So, keep another sheet where you track these payments.