How to Register a Business in Nova Scotia

By Arthur Dubois | Published on 14 May 2023

Nova Scotia is the most populous province in the Atlantic Canada region, and its capital, Halifax, is a central economic hub of the region. The business environment in the province is diverse and supports a variety of businesses, from small mom-and-pop shops to large multinational corporations. The province is great for agricultural businesses as well as businesses in the tourism, fishing, and forestry industries.

Nova Scotia also offers a variety of programs and services to help businesses start up, scale up, and succeed. These include The Self-Employment Benefits program, which provides financial assistance for Nova Scotians who are starting their own businesses, and the Registry of Joint Stock Companies service, which helps businesses register and incorporate in Nova Scotia.

If you want to register a business in Nova Scotia, you will have to choose a legal business structure, register a business name and obtain the necessary licenses and permits. If you are starting a business in Nova Scotia, in some cases you will need to register for a business number (BN) with the Canadian Revenue Agency (CRA).

You should register a BN if you require GST/HST, payroll, corporate income tax, or import/export business accounts. After Nova Scotia has registered your business, you will be able to start operating.

Learn more about our GST/PST calculator

Legal business structures in Nova Scotia

Defining the legal business structure of your company is one of the first steps in registering a business. This is one of the most important steps as it will determine the level of liability you and your business partners will have, how taxes are paid, and what government regulations you must follow. In Nova Scotia, you can choose from three major legal business structures.

Sole proprietorship

A sole proprietorship refers to a legal form of business owned by one person. Most businesses operating in Nova Scotia are sole proprietorships.

This type of business is easy and inexpensive to set up, and the sole proprietor has full decision-making power. However, you should be aware that as a sole proprietor, you are accepting all the risks, which means you are personally liable for all debts and obligations of the business.

If you already have a sole proprietorship registered in New Brunswick, you do not need to register again in Nova Scotia, as the province already legally recognizes your business. Nova Scotia does not legally require you to register your business if your business is related to farming or fishing only.

Partnership

Nova Scotia defines a partnership as an arrangement between two or more people who agree to cooperate in order to carry on a business or activity. Presently, there are two types of partnerships in Nova Scotia:

- General partnerships

- Limited partnerships.

All partners manage general partnerships equally. In a limited partnership, at least one general partner manages the business and is legally responsible for the debts and obligations of the partnership. The ther limited partners are only liable for the debts and obligations up to the amount of their investment.

Most partnerships should register with the Registry of Joint Stock Companies. This will give the partnership a legal identity to perform business activities in Nova Scotia.

Besides, you shouldn’t register a new partnership in Nova Scotia if you already have a partnership registered in New Brunswick, or if the main business activity of your partnership is fishing or farming.

Corporation

A corporation is the most complex business structure and it is usually only large businesses that use this structure. This is a legal entity that is separate from its owners, which means the owners are not legally responsible for the debts and obligations of the business.

Corporations provide many benefits. These include:

- Ability to raise capital by selling shares

- Flexibility in management

- Continuity of the business.

To incorporate Nova Scotia, you should fill out the:

- Memorandum of Association

- Articles of Association

- Statutory Declaration

- Notice of Directors and Officers

- Appointment of Recognized Agent

- Notice of Registered Office forms.

You will also need to pay the incorporation fee, which is currently $200. You may require legal assistance services to help with the incorporation process as it can be quite complex.

How to choose a business name?

Your business name is the first thing that potential customers will see, so it is important to choose a name that is catchy, simple, and easy to remember. You should also make sure the name you choose is available in Nova Scotia so that you can register it without any issues. For that reason, you can search the Registry of Joint Stock Companies to see if your desired name is available.

It is essential to ensure that your name is unique and that it reflects the products or services you offer. Generally, business names consist of distinctive, descriptive, and legal elements.

Distinctive elements are those that make your name stand out and that people remember, such as made-up words or personal names. Descriptive elements describe what your business does, such as “bakery” or “plumbing.”

And legal elements identify your business as a specific type of entity, such as “Inc.” or “LLC.” It is also a good idea to ensure that your business name is available as a domain name so that you can create a website and email address for your business. Additionally, you can check the availability of domain names through a domain name registrar.

If you want to register your business in Nova Scotia as a sole proprietorship or general partnership, you can register your business under your own name(s) without having to do a name search. However, it’s still a good idea to do a search to make sure your desired name isn’t already taken by other businesses in Nova Scotia.

What is a legal name?

If you’re incorporating a business, you must choose a legal name for your corporation. This can be your business’s operating name, but it doesn’t have to be.

Your legal name must end with “Limited”, “Limitée”, “Ltd.”, “Ltée”, “Incorporated”, “Incorporée” or “Inc.”. Try to choose a legal name that is different from the names of other businesses operating in your industry. This will make it easier for customers to find and remember your business.

You are not allowed to use vulgar expressions, physical, racial, or sexual slur words, and profanity in business names. Also, do not use words or abbreviations that suggest you have a government affiliation unless you are a society or have written consent from the government.

It is forbidden “Nova Scotia” or “N.S” at the beginning of your business name. ou can use it in the middle or end, before the corporate designation.

Register a business name in Nova Scotia

To register a business name, you should reserve it first with the Registry of Joint Stock Companies. You can do this by filling out and submitting the Name Reservation Request form. The form requires you to select the search type.

You should request an Atlantic region search if you are planning to do your business in Nova Scotia only. However, if you are planning to incorporate federally, you should request the Federal search.

Type your requested name and describe your business activities. You can find more information on different business activities on the STATcan website. The price includes the Nuans report, so you will receive the information on businesses with similar names operating in the Atlantic region or federally.

Choose your legal business structure and personal details, such as name, mailing address, and contact information. Make sure that your mail address and credentials are correct. Nova Scotia will send you the result by mail within three days.

Paying for your business name

Select the payment type in the last section of the form. Provide your credit card account number, expiry date, and card holder’s name. You can pay by using any credit card, including Visa, MasterCard, or American Express. You can also pay by cheque.

The name reservation fees vary depending on the legal form of your business. The name reservation fee for provincial incorporation is $61.05, and for federal is $76.25. Once you have filled out the Name Reservation Request form, you can submit it by mail to the following address:

Registry of Joint Stock Companies

PO Box 1529

Halifax, Nova Scotia

B3J 2Y4

You can also mail or deliver the form to the nearest Access NS Centre. Make sure to book an appointment to save your time. You can deliver it to the address below:

9 North, Maritime Centre

1505 Barrington Street

Halifax, Nova Scotia

B3J 3K5

Remember that before your application is approved, your business name is not reserved. It means that you should avoid printing any marketing materials, business cards, and stationeries until you receive the final approval. Wait for the final approval to avoid disappointment and unnecessary expenses.

You can also reserve your business name through the Registry of Joint Stock Companies online. Create your account, and click the “New Filing” menu. Select the “Reserve Name” to start the name reservation process.

You should fill out the Name Reservation e-form by providing your credentials, business entity type, and your contact information. The letter of consent can also be required if your business name is similar to a registered trademark or business name of an existing corporation.

Pay the fee using your credit card, and submit the form. You will receive the confirmation by email within two business days.

How to incorporate your business in Nova Scotia?

Sign in to your Registry of Joint Stock Companies account to start the incorporation process. Click the “New Filing” menu and select “Company Incorporation”.

You will be requested to enter your reserve name number. Additionally, if you want to use a numbered name, you are not required to reserve it. The Registry of Joint Stock Companies will assign your company a randomly-generated numbered name.

The first step requires you to state the business activity of your corporation. Check the STATcan website to find a NAISC code of your activity. You can also select your activity in a drop-down menu.

Memorandum of Association

Next, you should provide the Memorandum of Association (MOA), also referred to as articles of incorporation. This document must include the full names, addresses, occupations, purpose of the corporation, number of shares, registered address, and other details relevant to your business.

The MOA must also state the company’s purpose. You can generate your MOA based on the standard template or attach a customized memorandum.

If you want to generate MOA, you should fill out the personal information of each subscriber, including subscriber type, credentials, shares taken, and civic address. Subscribers can be an individual or a company. You can also assign a subscriber as a director of your corporation.

Further, you should press “Generate Memorandum”. Download MOA and have it signed by all subscribers. Scan and upload your MOA to proceed to the next step.

Upload the articles of association, or use Table A of the regulations of the Companies Act to set the rules for your business. Articles of association are the rules that set out how a business will be run.

They set out the powers and duties of directors, how shareholders will vote, and what happens if someone wants to leave the business. You should also upload the director’s consent.

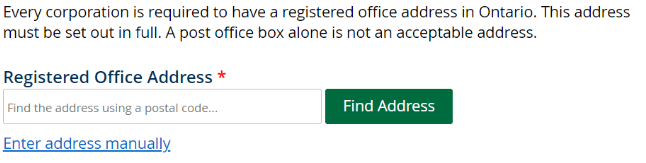

Continue the incorporation process by providing your registered office address. This is the legal address of your company and must be a physical location. It cannot be a P.O. Box. All legal documents related to your business will be forwarded to this address.

Further, fill out the form requesting information about the corporation’s officers and directors. If you have provided information about your director in the previous step, it will be automatically populated in the form. If not, you will have to provide the information manually.

You must also add a recognized agent. This is an individual that has a physical address in Nova Scotia and is authorized to receive legal documents on behalf of your business. The address of your recognized agent remains constant.

The Statutory Declaration

The next step requires you to download and fill out the Statutory Declaration. The Statutory Declaration is a form that declares that your MOA and Articles of Association are in good order and that your intended business is authorized to operate in the Province of Nova Scotia.

After filling out the forms and uploading all necessary documents, review your incorporation application and pay the fees. As of August 2022, the Nova Scotia Registry of Joint Stock Companies charges the following fees:

- Limited Company Registration – $200

- Unlimited Liability Company Registration – $1144.90

- Limited by Guarantee Company – $200

You will receive an email once your company has been registered, and you will be able to access your Certificate of Incorporation. You will also receive your Certificate of Registration and Business Number. The processing time is 3-10 days.

Top Canadian business credit cards for Nova Scotia business

If you’re a business owner in Nova Scotia, you know that running a business is no small task. From keeping track of inventory and expenses to managing employees and customers, there’s a lot to juggle.

A business credit card can be a valuable tool to help you manage your business finances and make purchases for your business. Many business credit cards offer rewards such as cash back or points that can be redeemed for travel or other perks.

This can be a great way to save money on business-related expenses. Additionally, business credit cards often come with higher credit limits than personal credit cards, which can be helpful if you need to make large purchases for your business.

American Express Business Platinum Card®

You should consider the American Express Business Platinum Card® if you’re looking for a corporate card with excellent benefits and perks. Some of the key features of this card include 1.25 Membership Rewards points per $1 spent on eligible purchases, $1,000 coverage for damaged or lost baggage, and American Express Experiences®. This includes access to exclusive events and tickets to popular shows and attractions.

American Express Business Edge Card®

The American Express Business Edge Card® gives you the purchasing power and flexibility to help manage the financial performance of your business. It is a valuable tool to help streamline your business purchases and track your expenses. The interest rate is very competitive (19.99% for purchases and 21.99% for funds advances), and you can earn up to 3 points for every dollar you spend on the card. You can also enjoy a variety of benefits, such as extended warranty protection and purchase protection.

American Express Business Gold Rewards Card®

Why just spend when you can also earn valuable Membership Rewards® points you can spend on merchandise and gift cards? The American Express Business Gold Rewards Card® gives you the opportunity to earn Membership Rewards points on every purchase, which can be redeemed for a wide variety of business expenses. Get up to 55 days interest-free on purchases when you pay your balance in full and on time each month.

Frequently asked questions about registering a business in Nova Scotia

You have to do the name search first. Reserve your desired business name by filling out the Name Reservation Request form at the Registry of Joint Stock Companies website. You will get the name reservation number you can use to register a business name in Nova Scotia.

The best way to register a small business in Nova Scotia is through the province’s Registry of Joint Stock Companies. The most common legal business form for small businesses in Nova Scotia is the sole proprietorship. However, you can also register your small business as a general or limited partnership.

The articles of incorporation in Nova Scotia are referred to as Memorandum of Association (MOA). You can find your MOA in your Registry of Joint Stock Companies account.

The business number is issued by the Registry of Joint Stock Companies after you complete the business registration process.

The business registration fee is $68.55 for sole proprietorships and partnerships and $200 for incorporation. The unlimited liability company registration fee is $1144.90.

Disclaimer: American Express is not responsible for maintaining or monitoring the accuracy of information on this website. For full details and current product information, click the Apply Now link.