How to Get a US Credit Card in Canada

By Heidi Unrau | Fact-checked by Maude Gauthier | Published on 25 Jan 2024

A growing number of Canucks who have canadian credit cards are looking for ways to get a US credit card in addition, because of the unique benefits they offer. With over 76 million credit cards circulating in the Great White North, Canucks love their plastic. But we also love all the cool stuff America has that we don’t – like summer in December and Disneyland. US credit cards typically have better sign-up bonuses and can help you build a US credit history. And since the U.S. dollar is generally stronger than the Canadian dollar, the idea of working in the U.S. can be attractive. Here’s how to get a US credit card in Canada.

US credit cards in Canada vs Canadian USD credit cards

Before we jump into how to get a US credit card, let’s prevent some confusion. Many Canadian financial institutions issue credit cards that are denominated in US Dollars, but they are not the same as a US credit card issued by an American financial institution. Here’s what to know:

- US credit card is issued by a US financial institution: you need to have a US address and a US Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- A USD credit card issued by a Canadian bank is beneficial for Canadians who frequently travel to the US or make many US dollar purchases: you can avoid exchange rate fluctuations because you pay your balance in US dollars.

Let’s take a look at how to get an American credit card in Canada without having to cross the border. It may not be as simple as ordering a coffee at Tim Horton’s, but it’s not as complicated as you might think. By following the steps below, you should be able to get an American credit card.

[Offer productType=”CreditCard” api_id=”6638ea018c0e5d5ce749e449″]Step 1: Get a US address

It may seem a little daunting, but don’t worry. You don’t have to move to the U.S. to get a U.S. address.

Fortunately, the address doesn’t have to be under your name. If you have any friends or family who live in the US, you can ask them for help. If they agree, you can sign up using their address and ask them to send any mail with your name on it to your Canadian address.

If you don’t have any American friends or family to count on, then you will have to find a service provider that offers US addresses to get a credit card. There are several mailbox or mail forwarding services that come with a US address. Most companies only charge for delivery and offer addresses for free. Please remember:

- The address must be residential as banks do not approve commercial addresses or P.O. box numbers; verify this by going to the USPS address tool and entering your new US address.

- The service provider must allow bank correspondence.

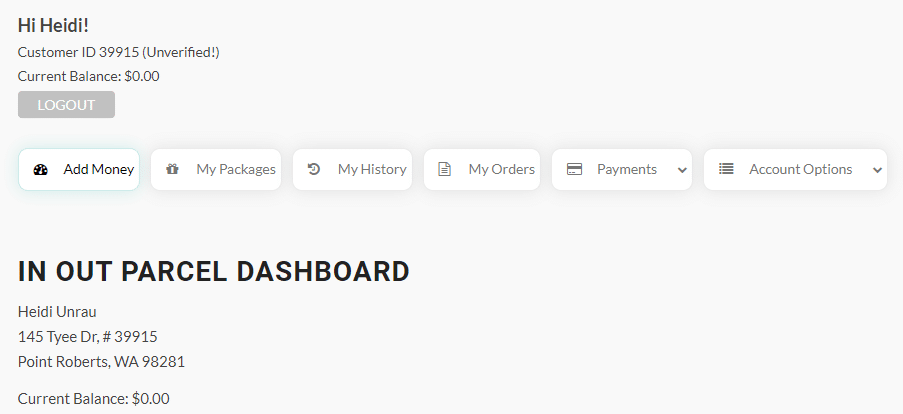

Have a look at some of the best package forwarding services and pick one that fits your requirements. Some of the top names include In Out Parcel and Shipito.

Be aware of the fees

Most companies charge an annual fee as well, which is in the range of $70 and $120. Make sure to verify there are no additional charges for using the address to receive bank letters. Also, ensure the address can be used to open a credit card.

Step 2: Open a US bank account

You will need a US bank account to be able to get a US credit card. You will need a bank account even if you do not intend to use a bank to get a credit card. This is because you’ll need an account to verify your address in the US and to pay off your US credit card bill. You can open a bank account in the US without having to leave Canada. Many Canadian banks have branches in the US. In most cases, you will have the option to open a US bank account when you open one in Canada.

The easiest way to open a US bank account in Canada

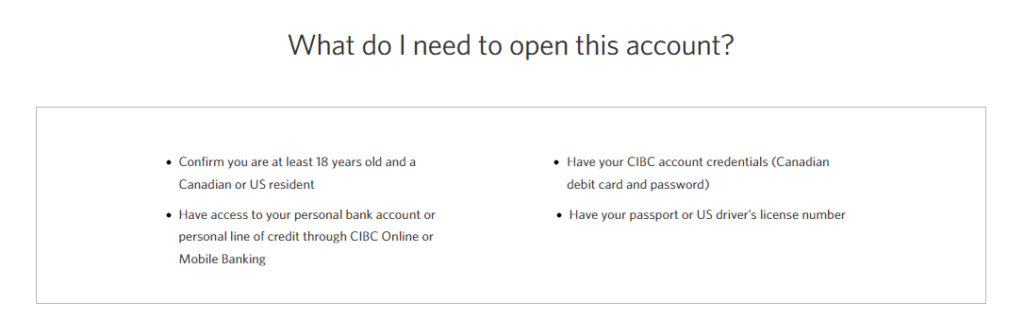

CIBC, for example, has this feature. If you use the bank for personal banking, you will get the option to get a USA Smart Account that’s free with no monthly fee and gives you unlimited transactions. The bank is reliable and gives the option to manage your account online. Plus, you will be able to transfer funds from your US account to your Canadian account as well as access your cash through CIBC Bank USA ATMs.

Some other banks that offer similar features include TD Canada Trust, Bank of Montreal, and RBC Royal Bank. All these banks give account owners the option to open a bank account in the US in just a few steps. In most cases, you will not even have to submit additional documents or wait for days to get a US account from Canada.

American banks that offer accounts for Canadians

If you don’t want to use a subsidiary of your current bank then you will have to search online and find banks that offer accounts to Canadians. A particularly popular option is Chase Bank. You will have to submit documents such as your passport and address proof. No matter which option you use, make sure to use your US address as your primary address on your new account. The address should be visible on your bank statements as it will be used by your card issuer to verify your address.

Step 3: Apply for a US Credit Card in Canada through Nova Credit

Now that you have a US address and a US bank account, the next step is to apply for a US credit card in Canada through Nova Credit. There are a few US cards that partnered with Nova which you can use to start building a good US credit score. This is important because getting a credit card without a good history can be an uphill battle.

Nova Credit: Start building a US credit score with an Amex card

American Express has partnered with Nova Credit, a service that allows Canadians and other US newcomers to directly apply for a US card using their Canadian TransUnion file. The process is quite straightforward.

Getting started

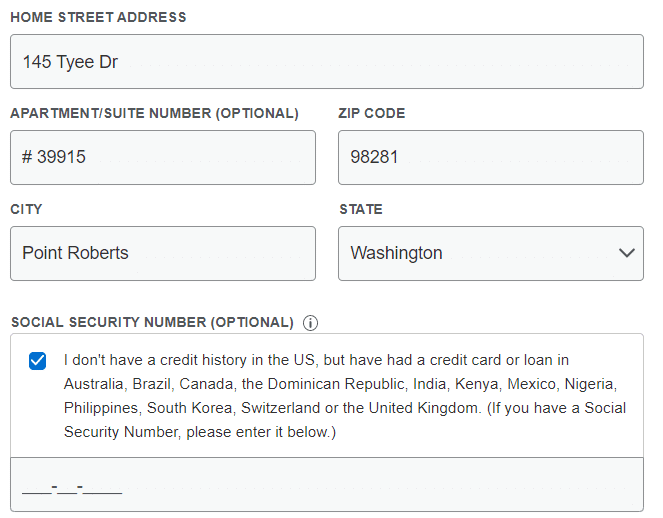

The service provided by Nova Credit will convert your Canadian credit report into the American equivalent. Simply visit the Nova Credit website and select Canada as your home country to see what US credit cards are available to you. For example, I applied as a new resident of the United States (thanks to my new US address) who does not yet have any credit history in this country.

When prompted for a U.S. Social Security Number, keep an eye out for a checkbox option that reads: “I don’t have a credit history in the US, but have had a credit card or loan in (select your home county)”. You will need to tick the box and select your home country from the drop-down menu. Continue following the prompts and providing the necessary information.

The system will then ask you to select the country of your credit history. Available options include UK, Canada, Mexico, India and Australia. Since you intend to use your Canadian background, choose Canada. Then, provide the required information such as your US address, date of birth, name and Canadian TransUnion record.

Verify your identity

Lastly, you will have to verify your identity by providing an identity document such as your Canadian driver’s license or passport. If you’re lucky, you’ll get approved right away. Conversely, in most cases, you’ll be asked to provide some more information to verify your data.

This includes submitting more identity documents and address proof. In some cases, you might be required to call the company and talk to an agent. Approval can take around four to five days. Once processed, your new card will be shipped to your US address.

Applying for credit cards

Applying for a credit card is the easiest way to start building your American credit history. To speed things up, you can apply for multiple credit cards, one after the other. Of course, not all requests are necessarily approved.

Already have a Canadian-issued Amex Card? Consider Transferring it

If you already have a Canadian Amex card, you can basically convert it into a US credit card. This method involves initiating an AMEX Global Transfer to the US from Canada. To be eligible, your existing Amex account must be valid, in good standing, and active for at least three months.

If you meet these requirements then get in touch with the AMEX Global Transfer office to request a Global Transfer from your Canadian card to your US credit card. The agent will ask you to apply for a US card on the phone and provide some details about the account. The process will take a few minutes and you’ll be asked to provide some information.

Step 4: Get an ITIN

As you can see, it is quite easy for Canadians to get an AMEX US credit card. However, if you want to get a card from other issuers such as Citi, Chase, Bank of America, or Capital One, you will need an ID. In Canada, we have a Social Insurance Number (SIN) and in the US, they have SSN, short for Social Security Number. Personal credit reports in the country are associated with these numbers or identifiers.

If you’re lucky enough to already have a SSN then you don’t have to worry about this step and you can move ahead. Only US citizens or residents with special permits can apply for an SSN. Everyone else needs to get an Individual Taxpayer Identification Number (ITIN). The US Internal Revenue Service (IRS) issues these numbers. You will have to prepare a number of documents to submit your application. The process can be a little tedious but it is important to ensure you can get your desired US credit card.

Hire a Professional

There are a number of firms that can help you get an ITIN. They’ll charge a small fee for their services and you will get your ITIN in just a few days without much effort. Some of our favourite providers include Frugal Flyer and US Tax Resources. You might come across even better options if you look around. Expect to spend about $350 CAD on it.

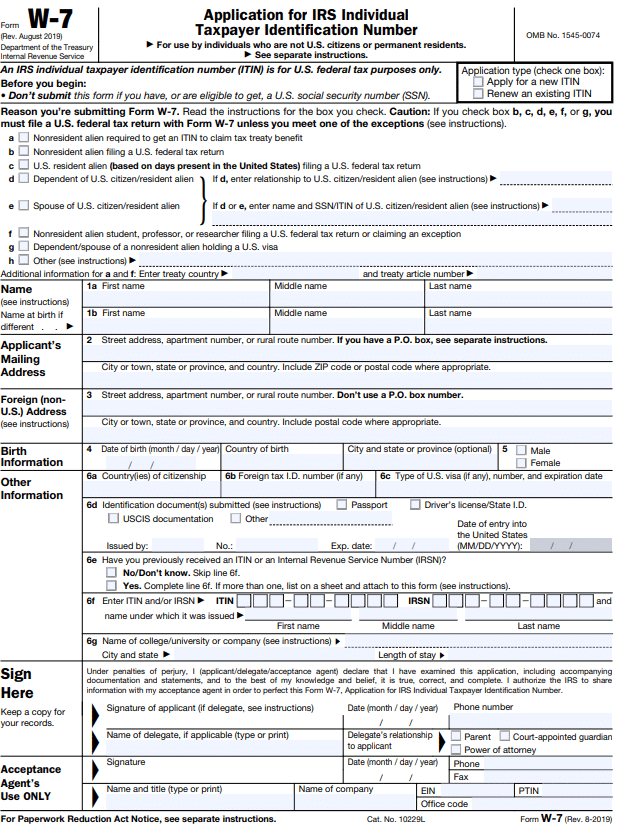

You will be asked to provide some information and the provider will issue a completed application form, also known as a W-7 form. You will have to prove why you need an ITIN. These companies can help you submit a tax return to justify your application.

Do It Yourself

Those who do not wish to hire the services of a professional firm can choose to apply on their own. This method is a little complicated and time-consuming but doable. Be careful when submitting your forms and even a small discrepancy in your form can result in a rejection. Fortunately, you will not have to wander for tips as the official IRS website provides all the information you need to get an ITIN. Go through the page to ensure you have all the required documents including:

- Document to justify an ITIN (for example, showing US-based income)

- A certified copy of your passport

- Correctly filled W-7 ITIN form

Also, getting in touch with a tax attorney for tax advice since submitting the W-7 form may have some tax implications.

Remember that the application cannot be filled out entirely online as you will have to mail your original passport or a certified copy to prove your status. Plan carefully as it can take around two months for the application to process. We suggest that you stick to certified copies since sending original documents is always risky. You will not be able to fly till you get your passport back. Plus, there’s a risk of losing it.

Once you have all the required documents, fill out the form and make sure there are no errors. Review it, collect all documents, put them in an envelope, and send it to the IRS at this address:

Internal Revenue Service

Austin Service Center

ITIN Operation

P.O. Box 149342

Austin, TX 78714-9342

Before getting your ITIN

When it comes to getting your ITIN, a few legal complications come into play. Foreign residents who earn income in the US are eligible and encouraged to apply for an ITIN. You will have to prove your residency status if you wish to be exempt from US withholding taxes. Your Canadian passport and address can be enough to prove it. An ITIN can be of help and prove to be very useful not only in getting a US credit card but also in using US-based services. It doesn’t matter how you have earned money in the US, you should consider getting an ITIN number as it will make it easy to fulfill your obligations to the IRS.

Reporting income to the IRS

Money can come from a variety of sources including trying your luck at a virtual casino, using US-based stockbrokers, or trying a US betting company. You will have to self-report your income to the IRC. This way you will get to save hefty withholding taxes that are levied on dividends, royalties, and winnings.

Step 5: Apply for More Credit Cards and Continue Building Your US Credit History

Once you have completed all the steps discussed above, it is time to get busy building your credit history so you can qualify for more (and better) US credit cards in Canada. However, remember that US banks are a little stringent when it comes to issuing cards. Don’t try your luck if you do not have a good credit score. Work on building a good credit history before you submit any applications because rejections can negatively impact your credit score. Be sure to build a good credit history with the AMEX cards mentioned in step 3 before sending applications, as rejections can negatively impact your credit score.

Chase Bank is popular as it offers some great rewards and a number of credit cards to choose from. You could also consider business cards including the Marriott Bonvoy Business Card from AMEX and the US Hilton Business Card from AMEX which are reputedly easy to get as you do not need an ITIN or SSN to be eligible. Contact the company over the phone to submit a request. You will be asked to provide an identity document though.

Top US Banks Where Canadians Can Get a Credit Card

AMEX and Chase are not your only options, you can also turn to other banks in the US that offer credit cards to Canadian citizens.

- Citi: Citi can be a great option for Canadians interested in earning Citi points. You can use these points to enjoy perks when flying domestically or internationally.

- Bank of America: This bank also caters to flyers with a special co-branded card that allows flyers special discounts when flying Alaska Airlines. The bank, however, only accepts applications in-brand or over the phone.

- Capital One: Here’s another reliable bank that can be great for Canadians who want to shop online. It offers generous welcome bonuses and special cash back programs when shopping online.

- Wells Fargo: This bank is particularly great if you’re trying to pay down a stubborn US credit card balance. They also have a strong lineup of credit cards that offer great cash back rewards and a wide array of eligible purchase categories to suit different shopping needs and preferences.

- TD Bank NA: If you love shopping at Target, TD Bank in the US offers the Target REDcard that gets you discounts and special perks as well as points on gas, dining and other card purchases. This bank is also known for various credit cards that offer different types of premium rewards to suit any preference.

Benefits of getting a US credit card in Canada

There are several reasons why so many people are looking to get a US credit card in Canada. Spoiler, it’s not just about cross-border shopping, but it’s still on the list!

Save more money

Most Canadian banks levy annual charges on credit card consumers, which adds to the cost. On the other hand, a large number of American financial institutions offer US credit cards without any annual fees. This makes it affordable to own a US-issued credit card. Plus, there are significantly more US credit cards that don’t charge foreign transaction fees, whereas only a few Canadian credit cards waive this fee. As the Globe and Mail explains, “Forex fees aren’t a big money maker for U.S. card issuers because most global credit-card transactions are conducted in U.S. dollars.” That has left a bitter taste in the mouth of Canadian globetrotters for years.

Although there are some Canadian cards that do not charge forex fees, there is a wider selection of US credit cards that have better rewards and no foreign transaction fees. This can help you save about 3% percent of the transaction amount. That adds up if you love to spend in the States!

Better rewards

As mentioned earlier, Canadian credit card rewards programs generally aren’t as generous as reward programs offered on US credit cards. Most Canadian institutions offer rewards valued in the range of 0.50% to 4% return on spending. Whereas in the States, rewards can go up to 5% on some US credit cards. Rewards can be in the form of cash back, discounts, and points that can be redeemed for travel, merchandise, statement credits, and more.

Let’s take a look at American Express Canada and Amex US cards, for example. The former offers only 8 hotel transfers and airline partners, whereas the US card offers 17 partners including some that no Canadian bank seems to offer such as Singapore Airlines and Aero Mexico. This can be a good reason to choose a US credit card over a Canadian-issued USD credit card.

Better travel perks

Not only is it recommended to use a credit card for travel expenses, but US credit cards are known to offer more benefits for travel lovers. If you’re a frequent flyer, a US card can offer you benefits such as access to certain airport lounges and hotel upgrades. Of course, you get that with some Canadian credit cards too such as the Passport Visa Infinite from Scotiabank.

Warning: Manage your US credit card responsibly

While getting a US credit card is easy, it is not something to take lightly. Do not make the mistake of being late on your payments. This may not impact your Canadian score but remember that your US issuers may have the option to follow you to Canada and get a judgment.

Debts you owe will remain active and may cause problems if you ever fly to the US or do business there. This is why it is important to handle your credit cards responsibly and pay your bills on time.

FAQs About Getting a US Credit Card in Canada

Yes, a Canadian citizen can apply for a US credit card, but it’s a process that requires patience and attention to detail. Most U.S. credit card issuers require a US Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), and a US residential address.

You will need to: Get a US address with the help of friends and family living in the States, or through a package forwarding service. Open a US bank account through either the American subsidiary of a Canadian bank like TD or CIBC, or directly with a US-based bank like Chase. Apply for an ITIN and submit the required paperwork and documentation. Once you’ve received your ITIN number, you can apply for your desired US credit card.

No, you do not have to fly to the US to get a US credit card in Canada. Everything can be done online or over the phone. You will first have to get a US address that can be used to manage bank correspondence and receive your first credit card. The address provider can mail your documents to you in Canada, thus giving you physical access to your card. The process is safe and seamless and involves building a good credit history so you can be eligible for more cards that come with better rewards and bonuses.

Canadian cards are quite good but not as beneficial as US credit cards, especially if you intend to use US services such as a US airline or shop with a US-only retailer like Target. US credit cards can be suitable for people who travel a lot and like to shop at stores not available in Canada.

There is no ‘best US card for Canadians’ as the right option depends on a variety of factors. Think about why you want a US credit card, what you’ll use it for, if you want to earn rewards, your shopping habits, etc. and pick accordingly.

Some cards offer airline miles, some are good for hotel stays, some have excellent cash back rewards, and some come with big welcome bonuses. Compare all options and pick what fits you the best.

Most US credit cards can be used anywhere that accepts credit cards, including physical and virtual Canadian stores. However, you may have to pay foreign transaction fees when you use a US card to shop in Canada.

Yes, you can use a Discover card in Canada. However, Discover isn’t nearly as accepted as Visa and Mastercard. There are very few retailers in Canada that accept Discover, so you should have a backup method of payment on hand.